A home loan having a balloon commission will get indicate that, whenever you are lower money occur till the deadline, you will end up left having to pay an enormous amount of cash at the conclusion of the borrowed funds label.

Home loan

Individuals who are seeking reduce their monthly installments will find a good balloon mortgage attractive. By this mortgage, only attention is paid off inside initial time period and then the complete amount need to be paid down completely during the expiration of the title. This allows borrowers to love straight down money if you find yourself located in its domestic. Nevertheless, this financing carries specific risks; when your property’s value drops or if you come across another type of financial hardship, you may not manage to refinance otherwise promote till the balloon payment is born. If you’re unable to make balance due, your house could sooner be foreclosed through to.

Balloon mortgages can be a financing-rescuing choice for people seeking inhabit their homes having a couple of years or flip it. Yet not, individuals have to be completely aware of the dangers and now have a repayment package able before taking the actual financing. Refinancing otherwise promoting earlier ought to be considered.

Auto loan

Balloon automobile financing are very theraputic for individuals requiring a car or truck but really provides inadequate earnings to handle the newest expensive monthly premiums. Using this financing structure, you might conserve to $100 or higher when compared with traditional car loans. However,, discover a capture; if loan develops, you need to pay an enormous portion of the very first pricing. This might produce challenges if you don’t have enough coupons or should your vehicle depreciates easily because of energetic use. In this case, refinancing may be essential, or you need make money personally to help you avoid people defaults.

Getting what you into account, automotive loans having fun with balloons are a great a style of acquiring good the newest vehicles without having to be stressed about excess money for every single few days. Nonetheless, its crucial that you inquire all perspectives associated with assortment regarding mortgage before signing towards dotted line. Make sure you know out-of exactly what will can be found whenever the mortgage reaches the readiness and exactly how far currency might be necessitated to your finishing fee. If you fail to carry out this type of expenditures, it tends to be more effective so you’re able to survey other funding choice alternatively.

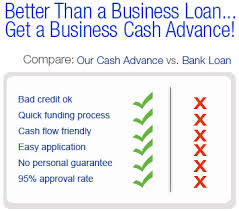

Business Financing

Groups that will be only birth and require currency rapidly to invest in start-right up will cost you may benefit off a preliminary-name balloon mortgage. This financing is generally removed getting step 3-5 years and you will necessitates regular payments about years. If title stops, the others are going to be repaid on time, if not “ballooned”. A preliminary-name balloon loan gets companies access to finance quickly, as opposed to traditional financing solutions that always take longer.

Companies favor a primary-title balloon loan because offers the money they need rather than them needing to wrap on their own down to long-name financial obligation. This loan is even helpful because it facilitates short payment that have extra cash move. Nevertheless, such borrowing has actually you’ll risks as well. In the event that a pals cannot pay back the fresh new due amount otherwise generate the money to your plan, they’re going to apt to be confronted with costs and you may fees that might place them inside an even direr economic problem versus before taking out the loan. Next, it is important to have company operators to closely familiarize yourself with the choice ahead of taking out a preliminary-term balloon financing.

For consumers with adjustable revenue that simply don’t qualify for a lot of time-name, fixed-price financing, an excellent balloon home loan are a solution. Due to their a balloon financial could be very theraputic for an individual who is actually to buy a property having a provider-financed mortgage.

Preciselywhat are some solutions to balloon mortgage loans? With regards to the problem, solution loans were traditional mortgage loans, USDA finance, Fingers (adjustable-price mortgage loans), and you may FHA finance. Could Pennington loans it possibly be beneficial to take out a good balloon financial?