Immediately after calculating his decades and you will value of , the partner was informed he is able to discover thirty five% out-of his house’s worthy of which have a guarantee launch plan. To invest their spouse an entire 50%, he is the reason the brand new shortfall playing with his or her own discounts.

Brand new couple’s security launch and you will divorce proceedings solicitors interact to prepare the program and take off the latest wife’s name about term deeds. Just after over, the newest guarantee discharge solicitor transmits the cash into her account.

In addition to the mental and you may monetary pressures of finding good brand new home after a breakup, today’s after life divorcees who need to maneuver domestic can get deal with strong battle off their buyers. Extremely sought after, well-maintained home are going to be expensive and you may often score snapped up rapidly.

When you are desperate for a property within your budget shortly after a separation, it will be worth exploring equity launch to assist purchase your next household. This can be done by using a mix of the fresh income arises from the newest relationship home and you can any savings you have got, and currency increased out-of a security discharge plan on the new home.

Example: using security launch to shop for a separate possessions

Several within their early-70s start breakup and you may agree that neither of those wish to save your family house. It sell its mutual assets hence introduces them ?440,000 otherwise ?220,000 each.

The new wife finds a house hence she will be able to pay for having fun with their show of funds from our house income. not, the newest spouse is unable to look for things suitable in this spending budget. He does yet not find an excellent assets having ?320,000.

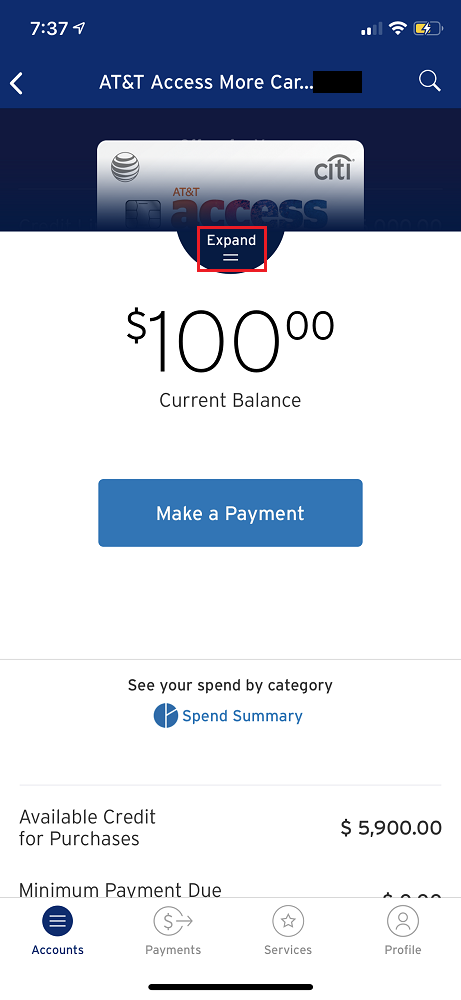

On account of their your retirement income being 71 yrs . old, the guy discovers that he is unable to secure installment loans online in South Dakota a home loan with the his new assets large enough in order to bridge new ?100,000 shortfall. Just after offered all of their possibilities, he chooses to program a collateral release propose to support the brand new purchase of his new home.

With the aid of their guarantee release adviser and you will a specialist solicitor, the guy launches ?100,000 out of his brand new home to place on the purchase of it. He’s got zero monthly repayments to make, so when the guy dies, his house is sold together with loan including desire is actually paid back entirely.

Collateral release is generally meant to be an existence relationship, thus is not always repaid until the history thriving resident entry out or moves towards the long-title proper care. not, there are affairs in the event the package must be current or perhaps avoid very early divorce proceedings are among them.

For those who as well as your spouse already have collateral discharge and you may splitting up , you will need to speak to your plan supplier getting advice off your own plan.

What goes on if an individual mate have our home?

Say your spouse otherwise lover motions away and you also want to capture full ownership of the property. Immediately following alerting your bundle provider of alter, your chosen solicitor is up-date the new property’s title deeds to mirror their unmarried control. The latest guarantee release bundle will keep on the term solely until you pass away or move into much time-label proper care.

What happens if the house is sold?

If you opt to promote your residence in your divorce case settlement then you can end their bundle early. You do that it by calling the financial and you will requesting to settle the loan in full. They let you know about the very last settlement shape which will is any attention and you may early cost charges owed.

As an alternative, certainly you might vent (move) their decide to your home on your only term, delivering your possessions matches the lender’s conditions.