Did you know you are qualified to receive several Virtual assistant loans not as much as specific points? For those who have marketed a past Virtual assistant-funded house otherwise enjoys repaid an earlier Virtual assistant financing, it is possible to be eligible for a special Va mortgage. With a couple energetic Virtual assistant mortgage brokers at the same time was a one-day allotment, to the merely exemption becoming necessary tasks that need to acquire a great family throughout the new place.

This permits you to definitely enjoy the great things about Virtual assistant loans even if you have utilized the Va mortgage advantages in earlier times.

Virtual assistant Loan Techniques for the Colorado

Protecting a great Va loan in Texas concerns multiple procedures, also seeking a Va-acknowledged financial, obtaining a certification out-of Qualification, and you may meeting required documentation such as for instance a career and you may tax suggestions, also financial statements. In addition, this new Va mortgage process need a great Va appraisal and insect check (if influenced by the newest appraisal), plus wisdom and you can controlling closing costs as well as the Va capital commission. While the conventional mortgage processes can vary, its necessary to become better-told regarding certain requirements having an effective Va mortgage.

Looking good Virtual assistant-Accepted Lender

Looking for a Va-approved financial is crucial to possess a delicate Virtual assistant financing procedure, since they’re regularly the particular conditions and you may guidance regarding Va financing in the Colorado. Types of Virtual assistant-recognized loan providers during the Colorado exists that have an online lookup but it are more beneficial to track down financing using a licensed mortgage broker eg Submit Financial Category.

You can also find most resources for locating Va-approved lenders from inside the Tx with the authoritative Virtual assistant webpages. Be sure to lookup and you can evaluate loan providers for the best fit for your needs.

Virtual assistant Appraisal and you can Pest Check

A great Va assessment is needed to make sure the possessions you may be to find meets Virtual https://paydayloansconnecticut.com/thompsonville/ assistant guidance in fact it is free from one major problems otherwise infestations. A pest assessment is needed in Texas in case your Virtual assistant appraiser identifies the home has actually a dynamic infestation otherwise a high probability of developing one to, that will be typically linked to termites. The newest Virtual assistant appraisal procedure inside Tx is like almost every other says, with Va commission appraisers deciding brand new practical otherwise market value of property to have Virtual assistant home loan guarantee intentions. This appraisal usually takes around 10 business days to accomplish.

Simultaneously, new insect review must be completed by the an excellent Virtual assistant-acknowledged pest inspector who is signed up and you may certified on condition out-of Colorado.

Closing costs and Virtual assistant Investment Commission

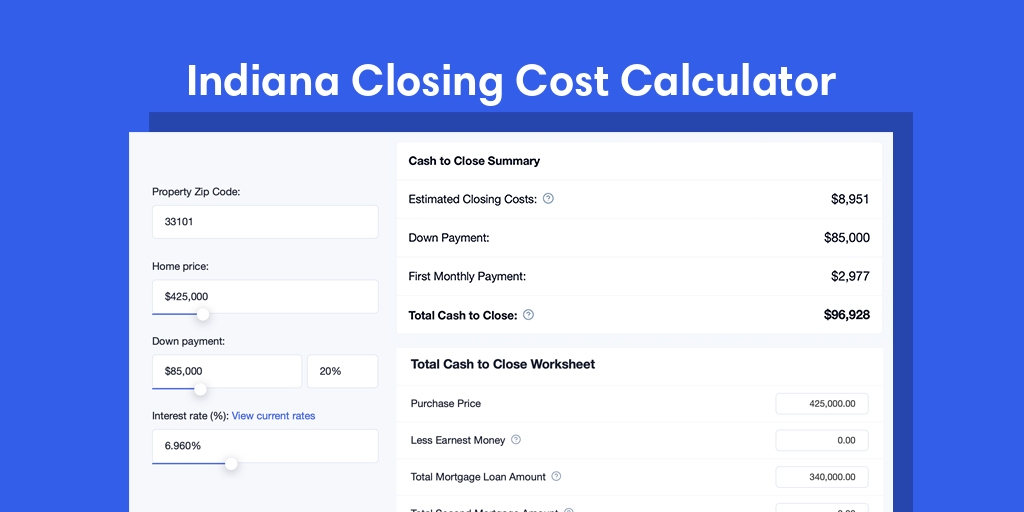

Settlement costs and you may Va money fees was extra costs associated with obtaining a great Va mortgage. Closing costs normally are appraisal costs, term charges, or other management can cost you. The new Virtual assistant financing percentage is a-one-time commission paid back to the Virtual assistant to aid defense the purchase price of one’s Va loan system. It commission try calculated according to the loan amount, the kind of financing, together with borrower’s armed forces updates.

It is essential to observe that any of these will cost you is generally protected by the seller or lender, given that provider will pay to 4% of the closing costs.

Va loan limitations and you can entitlements into the Colorado play a vital role when you look at the choosing maximum loan amount you could get instead of an effective advance payment. Such limits, labeled as the newest Virtual assistant financing maximum, differ based on the cost-of-living inside for each and every condition and you may believe the entitlement status.

County-Particular Mortgage Constraints

Inside the Texas, county-particular mortgage limitations dictate the most a debtor can obtain rather than a down payment, which may are different based on remaining entitlement together with price of staying in per state. Although not, if there is full entitlement, next Virtual assistant mortgage limitations dont pertain.