These types of money cannot be purchased otherwise guaranteed by the Fannie mae and Freddie Mac. Whenever you are to get an expensive home that’s along the loan limit, you ought to find a good jumbo mortgage financial. Jumbo money are used by the high-income borrowers to acquire deluxe assets within the rich elements. So you can safer a jumbo financing, you’ll want a high credit history away from 700 above, a bigger down-payment, and lots of offers. Of the costly amount borrowed, anticipate jumbo loan companies to-be stricter that have borrowing from the bank certification.

Take into account the Disadvantages

There is certainly a trade-out to the lower FHA advance payment and you may everyday credit conditions. Because the you’ve observed, mortgage cost (MIP) are a supplementary commission. MIP gets costlier the fresh longer you pay for the mortgage. Ergo, some FHA individuals at some point refinance on a conventional loan to cease MIP.

FHA funds and realize necessary loan restrictions. This is in accordance with the area of your property, with reduced-pricing elements with a lowered limitation. If you are looking so you’re able to acquire a costly loan amount, these types of home loan may well not work for you. Second, you should think of minimum assets standards imposed of the HUD. While applying for an old domestic accepted, you could have a hard time that have a rigid appraiser. Ultimately, you can only take an enthusiastic FHA financing when you’re using the house just like the an initial household. It is really not qualified to receive leasing property or travel property.

Estimating FHA Home loan Costs

FHA financing was a stylish selection for very first-go out homeowners of the reasonable down-payment. Prior to you determine to create a tiny deposit, let us find out how it affects home loan can cost you. Guess you are to get a home costing $280,000 and you are clearly taking a thirty-12 months repaired-price FHA mortgage at step three.5% Apr.

Your credit rating try 580, so that you produces an effective step three.5% downpayment. The second table reveals differences in mortgages will set you back for those who shell out 3.5% down as opposed to ten% down.

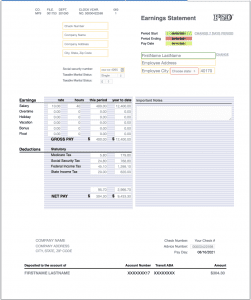

30-seasons fixed FHA loanHouse speed: $280,000Interest speed: 3.5% APRAnnual a home taxes: $dos,400Annual homeowner’s insurance policies: $1,000Monthly HOA charge: $1003.5% Advance payment: $nine,80010% Down-payment: $28,100000

With regards to the analogy, for individuals who shell out step three.5% down, your loan matter will be $270,200. At the same time, for folks who spend 10% off, the loan matter could well be faster so you’re able to $252,100. The greater amount borrowed results in higher payments into the upfront MIP payment, complete monthly financial, and you may total attention charges.

Having step 3.5% off, your own initial investment payment was $cuatro,. But with ten% down, their upfront MIP would-be $4,410, that’s straight down because of the $. Regarding overall month-to-month mortgage repayments, it might be down by the $ for many who pay ten% down.

Although not, spot the massive difference whenever we examine total focus can cost you. That have step 3.5% down, your own overall notice fees is $139,. Simultaneously, with 10% down, their total appeal can cost you will be less so you’re able to $130,. Contained in this analogy, it can save you $nine, over the life of the loan if you make good 10% advance payment.

This case reveals and then make increased deposit will assist raise their home loan offers. Even after limited income, endeavor to save your self as often advance payment as possible to have less costly monthly installments. When you’re concerned with the extra cost of MIP, you might fundamentally refinance for the a traditional loan immediately following a couple of out-of ages. You can qualify proceed this link here now for refinancing if you’ve achieved about 20% security of your property and you can a credit rating of at least 620.

To put it briefly

FHA funds are ended up selling since financial options for borrowers having reasonable credit scores and you will restricted incomes. It’s a nice-looking financial support product getting very first-time homeowners shopping for an inexpensive advance payment solution. Consumers is qualify which have a credit score as low as 500. However, due to the fact a swap-from, he could be needed to make a beneficial 10% advance payment. Meanwhile, consumers having a credit history out of 580 deserve make a step three.5% deposit to the an FHA loan.