This might be problematic so you’re able to few that have people coupons requirements you enjoys. But while the cost can come down later this season anyway, you really have some time to equilibrium each other obligations repayment and you may saving.

To obtain advised precisely how loan providers have a tendency to perceive you, check your credit score. You will be lawfully permitted a free credit report away from each of the three credit bureaus once a year.

It’s a monotonous activity, it can be helpful to undergo you to definitely statement range by line. If you learn people mistakes-including a statement reporting since the delinquent after you know your repaid it-you might disagreement it. Immediately following it will become fixed, it has to give your credit rating an enhance.

#3: Hold off and work out Changes

- Remain in your job. Loan providers want to see consistent a job background. This provides new borrower having a constant salary they are able to use and also make its mortgage payments. Therefore if you’ve been considering a position disperse, wait up until after you get.

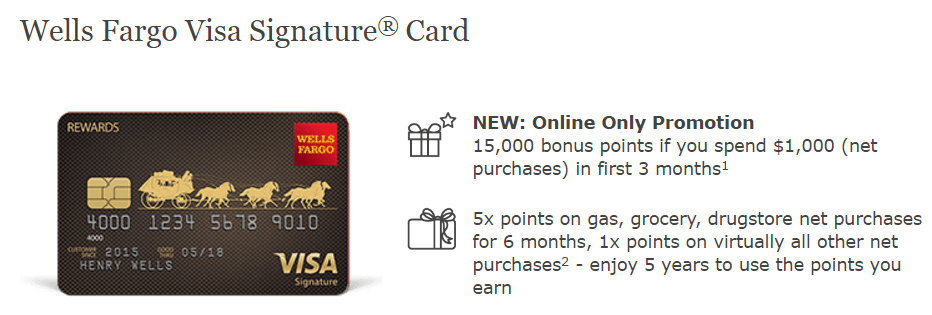

- Do not accept the fresh new loans. Making an application for people the fresh new credit-whether or not that is a car loan or a charge card-causes a plunge on your credit rating. That is because the possibility borrowing from the bank issuer checks your credit score as the element of you to software procedure. Which difficult credit assessment drops factors from your own rating. If you wish to get the best home loan price, need your score to get as much as it is possible to. For the moment, prevent doing anything that would need a credit assessment.

- Keep dated lines of credit unlock. Credit agencies factor the age of their credit lines to the your credit score. Older borrowing form you’ve sensibly treated those funds for extended, it helps improve your rating. Including, having even more credit offered improves your borrowing from the bank use ratio. You could think counterintuitive, however, closure one handmade cards will cause your own get to help you drop. Before you go to try to get home financing, remain those credit lines discover. That does not mean you have to utilize the credit.

#4: Consider Official Financing Applications

I said some of the all over the country programs readily available for first-day homeowners, for example Fannie Mae’s HomeReady and you will Freddie Mac’s Domestic You’ll be able to. We in addition to touched with the FHA, Virtual assistant and you can USDA loans in Fruitdale money, that are supported by the government. Beyond one to, of several states provide homebuyer applications to have very first-day otherwise financially disadvantaged borrowers.

Fundamentally, you may possibly have selection around beyond the traditional mortgage loan. Do your homework to determine and this applications you could qualify for. Many helps you rating a lower life expectancy mortgage focus price.

#5: Check around

For individuals who simply stick to that tip-on which number, allow it to be this one. Here is the most practical method to be sure you’ll get a great aggressive interest rate on your own financial.

Demand a speeds quote away from a number of lenders. Considering whatever they promote, make an application for home loan preapproval which have at the least about three.

Should you get financing Estimate straight back out-of per bank, look for this new annual percentage rate (APR). This signifies the yearly price of the borrowed funds, in addition to not only the speed however, one charge regarding the lenderparing APRs along the three lenders enables you to choose and therefore loan will obviously function as least expensive for you.

Sure, making an application for preapproval with quite a few loan providers demands most performs. But if you need some added bonus to try out they, a relatively present learn from Freddie Mac can help. It found that homeowners who compared mortgages away from just several lenders conserved on average $600 annually. Consumers whom had five or maybe more rate rates conserved more than $step one,2 hundred per year.