Navy Government Borrowing from try the website the bank Partnership home business funds review

Navy Federal Borrowing Partnership focuses primarily on enabling army provider members, veterans, Agency out-of Security team in addition to their friends availability high quality financial qualities.

You need to be a cards connection affiliate into the its individual banking side before you sign up for company registration, and you may must be a corporate affiliate before you can sign up for a business financing. Navy Federal was interestingly rigid-lipped on the the business loans, however, considering their high customer satisfaction ratings because of its private banking offerings, it could be beneficial for many who curently have a merchant account here.

Title loans

You could sign up for a basic providers title financing you are able to use to possess many motives, along with devices investment , providers extension or strengthening developments. You will be expected to back their label mortgage having equity (when you’re committing to possessions otherwise gizmos, you are able to your new buy).

Navy Government allows you to use to 75% of the price of investment a special equipment purchase – meaning that you will have to assembled a down-payment of at least 25%. Unfortuitously, Navy Federal cannot render one personal-facing information regarding the price otherwise name of your own funds until you probably sign up for a loan. You may want to be able to get an enthusiastic SBA financing courtesy Navy Government.

Line of credit

Navy Federal offers two types of lines of credit: a corporate Credit line (BLOC) you could mark against as required otherwise an examining Range regarding Borrowing (CLOC) that caters to to fund overdrafts from your own Navy Government organization examining account. You’ll need to offer a global security for everybody BLOCs (theoretically it is therefore a protected providers line of credit ), since the CLOC are equity-100 % free.

Together with attention, you can easily spend a yearly $325 percentage for a good BLOC ($50 getting a CLOC), if you utilize it or perhaps not. Navy Federal also has a beneficial clean-right up several months for most BLOCs, requiring that remain an effective $0 personal line of credit harmony for around 31 successive schedule weeks annually, meaning you simply can’t draw on that credit line through that months. Make sure you has actually a before-upwards plan in place so this doesn’t connect with funds move.

Commercial a property money

If you’re looking purchasing, refinance otherwise renovate your organization area otherwise a residential property, Navy Government could possibly assistance with a commercial real house mortgage . There are no prepayment charges, although there are many almost every other a property charge.

Sadly, you will never observe much these types of charge would-be or also first info like the selection of costs the credit connection was charging you if you don’t sign up for a loan. You may be in a position to select from fixed otherwise changeable pricing, yet not.

Navy Federal Credit Commitment debtor criteria

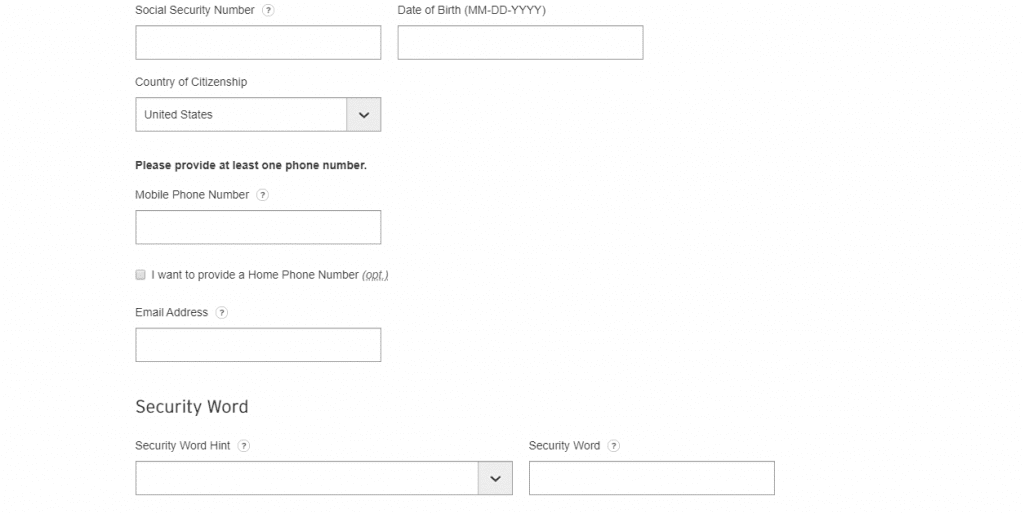

Navy Government Borrowing Connection features most rigid business loan application standards . You need to be a corporate user before you could apply when it comes down to resource options whatsoever. Becoming an associate, you will have to fill in a long application, purchase doing one hour for the mobile with good banker and put down in initial deposit off $250 so you’re able to $255, depending on your company style of. For those who have business lovers or co-residents, they will certainly each should be individually qualified, and implement to possess subscription too.

Navy Federal Credit Commitment cannot provide preapproval towards any of the financing solutions. There are also conditions to have time in business before you even sign up for their providers credit line, name fund and you will commercial vehicles funds. You’ll need to have been a great Navy Federal company representative getting one or more 12 months otherwise have been in organization for from the minimum two years before you apply.

If you’d like a corporate mortgage promptly, Navy Government will never be a feasible solution unless you are already an created member therefore you should never brain a challenging borrowing from the bank inquiry exhibiting on your personal credit report to check your financing choice with this specific bank.

Required documents

For people who have not but really applied for an effective Navy Federal providers mortgage you will be leftover in the dark on what it does present, but something it is rather initial throughout the ‘s the records possible have to pertain. (Think of, that’s incase you truly meet the criteria to try to get a loan first off.) The desired records are different based what sort of financing you may be trying to get, but fundamentally is:

- Business strategy

- Personal be certain that

- Done loan application

- Organization and private tax statements from the past 24 months

- Certification regarding insurance rates (having auto and you may equipment sales)

- Current providers economic comments, including profit and loss comments, aging records, harmony sheets while some.