Loan providers is slow beginning to set its home loan purchases straight back into the on the business, however, costs are now greater than in advance of.

More than step 1,500 mortgage loans were withdrawn during the last times from Sep, ultimately causing average cost into the a few-12 months fixes ascending so you’re able to a great fourteen-seasons high.

Right here, i establish why financial institutions removed the sales and you may story the most affordable mortgages still designed for household moving companies and you can earliest-go out people.

Which publication brings totally free currency-relevant blogs, together with other details about And therefore? Group services and products. Unsubscribe anytime. Your data might be processed according to all of our Online privacy policy

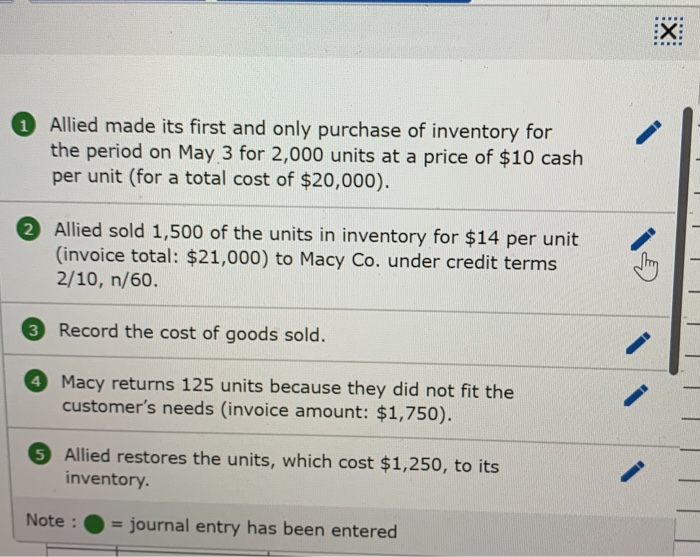

Significantly more than, we’ve got detailed the brand new deals with the lowest priced 1st costs. This provides a good indication of the pace you might be able to get, with respect to the sized their deposit, prior to opting for a package you will additionally need certainly to factor in initial fees.

Specific loan providers fees fees as high as ?step one,999 on the reduced-price product sales. Because of the charging you highest fees, loan providers can offer better pricing and you will recoup the latest shortfall someplace else.

Banks commonly charge costs eg ?999, ?step 1,499 otherwise ?step one,999, however some explore percentages as an alternative – such as for example 0.5% of the total loan amount. While borrowing a bigger sum, this is exactly so much more costly.

It is possible to usually need to pay a premium of 0.2%-0.5% to find a fee-totally free contract. Both, this can repay. For example, when you can score a home loan in the 5.5% having a beneficial ?999 payment, otherwise 5.6% with no payment, the latter was lower along side repaired term.

If you’re unsure in the which type of price to go for, home financing adviser should be able to analyse income considering its real cost, taking into account rates, fees and bonuses.

Are you currently concerned with your finances?

Address a few questions and we’ll leave you a personalized number out of expert advice to help you take control of your money.

How much time any time you boost your own home loan getting?

One of the greatest concerns with regards to mortgages is actually: for how enough time if you protected your price?

Borrowers most frequently remedy for sometimes several or five years. Five-year sale were immediately after a whole lot more pricey, in extremely hours it’s now actually decreased to resolve to possess expanded.

Five-year fixes always have higher very early fees fees, meaning that you might be recharged a lot of money for folks who ple, for those who disperse home and don’t import it on the the fresh property).

Being mindful of this, you will need to remember their average and you may enough time-label agreements just before buying a predetermined title.

Hence? Money Mag

Find a very good marketing, prevent frauds and you can build your deals and you can investments with your pro suggestions. ?cuatro.99 thirty days, terminate whenever

What goes on second from the financial market?

People into the adjustable-rate income (for example tracker mortgage loans ) are really confronted with feet price change, but people visiting the termination of its repaired terms try today planning to find a lot higher prices once they remortgage.

Its likely that home loan prices continues to boost in the brand new short-term, having subsequent feet rates nature hikes on the horizon.

Should your fixed title is originating to an-end, its as essential as actually ever so you’re able to remortgage just before are shifted toward lender’s practical adjustable speed (SVR). For many who lapse on best medical loans for surgery to your own lender’s SVR, their speed may go up when the bottom rates does.

And therefore? Currency Podcast

Into the a recent bout of the latest And therefore? Currency Podcast, we chatted about what the dropping property value new pound and you may rising rates imply for the currency – such as the effect on mortgage loans and you can household prices.