In the a densely inhabited nation such as Asia, having your individual, safer haven, a peaceful abode are a dream for everyone. Most of the people in the united www.clickcashadvance.com/installment-loans-al/carolina kingdom reside in rented leases otherwise belongings . It was plain old trend for quite some time. However,, with the rise in the actual home community, anyone have your options for buying a property of its alternatives.

However, the absence of a great deal of bank equilibrium possess left the possibility consumers and/or desperate ones out of to get its dream residential property. Right here appear the advantage of mortgage techniques. For those, who’ve a minimal budget and cannot be able to purchase an excellent household at a time using their very own lender balance, the house loan opportunity is a wonderful means to fix pick a good domestic in the Asia.

If you’re looking to buy a home during the Asia, here is a step by step self-help guide to mortgage process when you look at the India.

The application form Techniques to own Mortgage during the Asia:

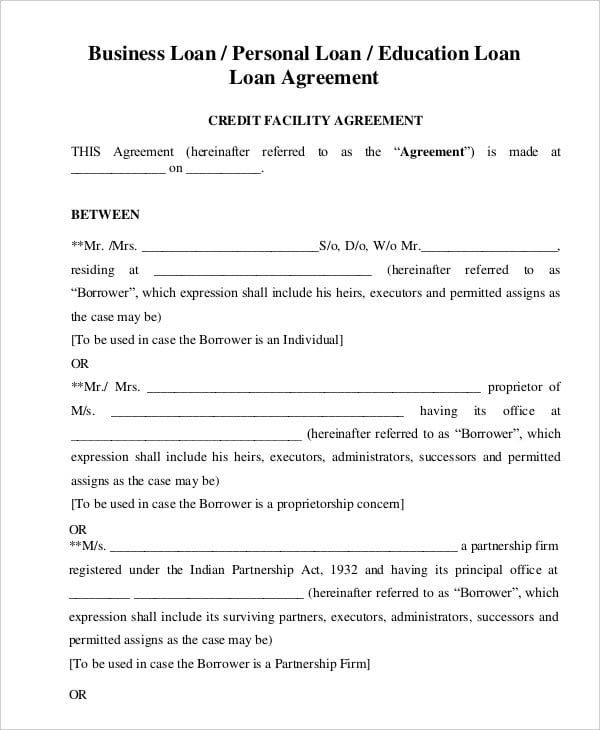

Here is the first faltering step towards mortgage process in the event the you’re looking for a complete home loan procedure step because of the step . The new applicant must document an application toward financial add up to the financial institution and/or financer. Here it’s important to add every requisite information of the candidate because the lender will need to scrutinize his/their own qualifications to track down the mortgage and you may financial condition. For the, new candidate has to promote toward application the second documents. They’ve been

> How old you are proof > Label evidence > Address evidence > A position information > Money proof > Existing property details

Constantly, financial institutions posting its managers otherwise agents towards the applicant to possess acquiring these details. However,, oftentimes or some banks may need the latest candidate in order to check out the economic institutes for submission the application form .

Processing Fee

To keep the whole process of mortgage recognition, specific banks ask you for a processing percentage. Normally, this is 0.25% so you can 0.50% of one’s overall mortgage count and have, this is exactly a low-refundable fee. However,, not all the finance companies ask you for which operating fee. And additionally, you could potentially discuss towards the lender to minimize otherwise reason so it operating fee.

Verification regarding Repayment Strength

Here is the most critical area of the home loan process inside the Asia or in other words in just about any other country for instance. As candidate has actually paid for the latest processing costs, the financial institution will quickly make sure new records. Because of it, the lending company will require a lot of facts regarding the applicant and you will make certain and take a look at these to browse the financial status and you can loan eligibility of the candidate. These details should include

> The fresh applicant’s financial equilibrium > Average savings > Paying designs > Number of view jump more, new tough > Expenditures if any investments imply that brand new applicant can afford the off costs with the mortgage. Considering these details, the financial institution often pick whether or not the applicant is eligible on the loan or not. Its during this period that the financial have a tendency to often approve your loan otherwise deny they. As well as the previously mentioned details, the bank will make certain next > The earlier residential address > Your existing domestic address > Contact number of one’s residential address > Your own a job business and its address > Brand new credentials and details of your employer > Contact number of workplace otherwise office.

The member regarding the bank will visit the place of work and household of applicant. The brand new associate commonly guarantee every piece of information that are stated within the the application to have. Along with, some times, new references that will be stated regarding the software to possess by the applicant is featured and you will confirmed by associate. Thus giving the new banker a very clear amount of faith and therefore is really very theraputic for the fresh new acceptance of one’s loan application.