After construction is finished, the home will need to be inspected of the a good Va-acknowledged inspector to ensure it suits minimal possessions requirements.

Requirements for the home, including liquid availableness and you will easements, are inspected prior to design begins. Once build concludes, however, an effective Virtual assistant-recognized inspector monitors to make sure the property suits minimum criteria connected with:

- Size

- Power availableness

- Structure and you will soundness

- Zoning and you will strengthening rules

- Pest inspection

So it evaluation techniques can result in a lengthier loan-approval process, also it can take longer to possess borrowers to shut for the good Virtual assistant framework financing than simply which have a normal mortgage. Certain home buyers may choose to play with option resource to acquire belongings and create a home to quit the fresh new timeline restrictions associated that have a good Va financing. They may next get a great Va financing re-finance with you to definitely of the finest mortgage refinance businesses (including PNC Lender and you may Quality Home loans) at a later time, replacement their fresh mortgage with a great Va loan offering straight down focus cost. However, a refinanced house need to still meet up with the VA’s lowest property criteria before the the brand new mortgage is going to be closed.

The brand new Virtual assistant does not set limitations towards the assets size, but mortgage lenders are hesitant to approve a loan to your oversize qualities.

There are not any specified acreage limits towards Virtual assistant framework financing. The theory is that, a borrower can use a beneficial Virtual assistant design mortgage to acquire several regarding acres out of home and build property. In practice, yet not, its impractical one a loan provider have a tendency to approve such as for example that loan. Lenders have a tendency to bashful out of higher land sales due to the elevated risk that is included with financial support a keen oversize possessions. By way of example, if the debtor non-payments on the loan, the lender have to deal with recouping will set you back because of the selling off of the highest parcel of land, that may be more challenging than simply selling shorter features.

Appraising oversize qualities shall be tricky as well just like the lenders could have a tough time searching for comparable characteristics to truthfully determine the new land’s ount might restriction simply how much homes a borrower can buy whenever they don’t have its complete entitlement. A great borrower’s entitlement is the count this new Virtual assistant is actually happy to shell out on the lender when online payday loans no credit check Vermont they standard on their home loan. The utmost essentially may vary by county, thus individuals may prefer to see the financing restrict within their state and you will assess its kept entitlement before applying for a financial loan. When consumers pull out an excellent Virtual assistant loan, they normally use a portion of their entitlement, which they is also heal because of the settling its mortgage. The latest Virtual assistant will get make certain a smaller percentage of a mortgage when borrowers provides a diminished entitlement, which could possibly get impression how much they be eligible for with an effective Va financing.

If you are you can find constraints to purchasing belongings which have good Virtual assistant financing, it can be the right financial support choice for eligible borrowers which discovered the best destination to make their fantasy household.

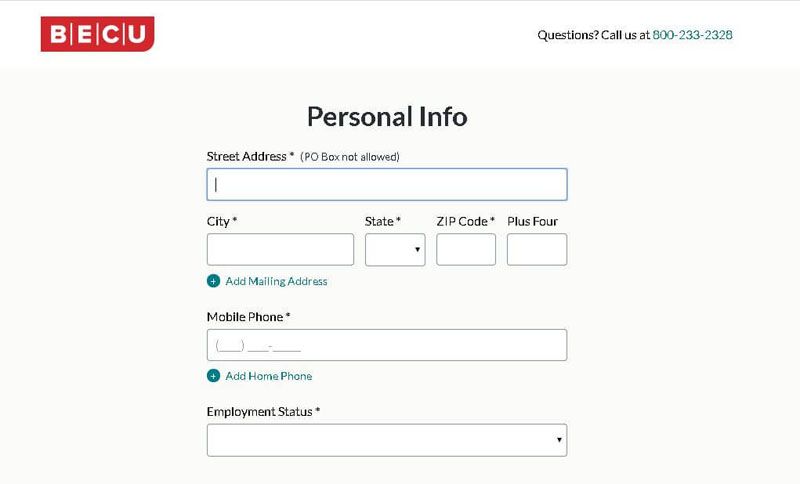

Experts and you may service people that prepared to buy house and you may create their new family will see good Va build mortgage in order to be the primary financial support choice. Before structure will start, not, individuals need to find best lending company that gives Virtual assistant structure fund. Borrowers might also want to meet a beneficial lender’s eligibility standards whenever obtaining an excellent Va loan: lowest credit score conditions, limit loans-to-income (DTI) percentages, and you can a career position, certainly other factors. Because the Va doesn’t set an optimum DTI proportion or minimal credit score for Virtual assistant mortgage approval, possibly the ideal Virtual assistant mortgage brokers instance PenFed and you will Navy Borrowing Government Relationship will most likely has their unique minimum credit history requirements.