Contemplate our very own creating cluster just like your Yoda, with pro financing pointers you can rely on. MoneyTips teaches you basics simply, versus bells and whistles or formality, to live the best economic lives.

Nathan connects with individuals, teams, and reports channels to help teach them into the currency issues and you may turn on economic feel. The guy believes you to gaining economic achievements begins with pinpointing the goals and you can up against them head-on. You really have seen Nathan on your regional reports route speaking throughout the playing with handmade cards responsibly, strengthening good credit, plus.

If you have been thanks to bankruptcy proceeding, you could feel far more cautious than ever before regarding taking out fully the fresh finance especially on your own family. But if you will be mindful and you will wise, refinancing can help you save money and you may discover the newest collateral inside the your home at a decreased-rate of interest.

Reduce your interest

Cutting your interest from the step one% or higher could save you hundreds monthly. Consider, that’s currency you are able to to pay down the money you owe, create a crisis account and you will balance your finances for future years.

Eradicate home loan insurance

For those who sometimes grabbed out a conventional financing and paid back shorter than just 20% down or you got aside a national Property Administration (FHA) financing, you are probably paying a monthly financial insurance policies percentage.

Get a fixed interest

When you yourself have a varying-rate mortgage, don’t forget that their monthly obligations increase once your introductory rate closes. Refinancing could help you lower your monthly mortgage repayments and get just before future interest expands.

A predetermined interest can present you with a greater sense of financial stability. Your monthly mortgage repayments will continue to be a similar to the lives of financing. Might help make your enough time-name cost management simpler and replace your finances.

Bring cash-out

If you have been and make their monthly mortgage repayments plus domestic has increased inside well worth, you might be capable take advantage of your home equity which have a money-away refinance.

What are the Demands in order to Refinancing Immediately following Case of bankruptcy?

Before you re-finance, you’ll want to take into consideration that case of bankruptcy really does atart exercising . pressures for the refinancing process.

In search of a lender

It’s not necessary to cover up your case of bankruptcy from the bank. In fact, you simply cannot cover up they, and you will imagine concentrating on the bank search. Look for loan providers who’ve caused consumers with went thanks to case of bankruptcy.

Delivering a favorable rate of interest

After bankruptcy proceeding, your credit score will require a primary struck. Additionally the lower your credit history, this new less likely you are locate approved getting a mortgage.

Even though you will get recognized, you might not qualify for a knowledgeable rates of interest the lending company offers. Large rates often increase the total will set you back of financing and you can negate people financial benefit you hoped to gain of refinancing.

Supply your self a knowledgeable opportunity to qualify for a lowered rate of interest, manage improving your credit history and you may personal debt-to-income (DTI) proportion through that window of your energy amongst the case of bankruptcy launch and when you make an application for a good re-finance.

Getting the lender having papers

Additionally, you will need to works a tiny more challenging to add their bank with all the documentation they are going to need to understand debt disease. This could is creating a page of factor one facts the fresh new reason(s) for the personal bankruptcy and you will what you are currently carrying out to turn something to.

Negotiating settlement costs

After you close for the a mortgage re-finance, you have to pay closing costs (always step three% 6% of your own loan’s value). A portion of these types of closing costs commonly comes with origination costs (mortgage processing fees) or other fees energized by lender.

If you’re lenders can be happy to tell you some flexibility with our costs, they may reduce incentive so you’re able to waive the fresh charge on account of the extra scrutiny the job may need. It is very impractical that all of your own settlement costs is waived from the financial.

Just how long Will i Must Wait To help you Re-finance Immediately after Bankruptcy?

Your own waiting is based on the type of bankruptcy proceeding you registered having and you may if the sort of loan you want to help you re-finance that have are a normal loan otherwise a government-backed loan.

A bankruptcy proceeding bankruptcy

That have a part 7 personal bankruptcy, you and your lawyer document good petition to the court one claims you can not repay a number of your debts. A few of your own personal assets was sold out of from the a case of bankruptcy trustee to repay the qualified bills. Shortly after 90 100 days, your own case of bankruptcy loans in Redland is actually discharged. Which implies that creditors are unable to always you will need to assemble.

Still, you will not end up being 100% off the financial obligation hook. You can easily still have to repay certain kinds of obligations, eg college loans, child service or any other legal-bought judgments. Your bankruptcy proceeding will stay in your credit report for up to ten years.

Chapter thirteen bankruptcy proceeding

After evaluating the money you owe, a bankruptcy proceeding courtroom will work with your financial institutions to come up that have a fees bundle. The master plan have a tendency to reconstitute a portion of your debt and you may consolidate your instalments towards the you to payment per month which you’ll build so you’re able to an effective bankruptcy proceeding trustee along the second step 3 five years. (Possible remain guilty of figuratively speaking and other costs you to just weren’t entitled to the fresh fees plan.)

After the latest repayment plan, the case of bankruptcy gets released. Your credit score takes a smaller strike, therefore the bankruptcy will stay on your own credit history to possess up so you can eight many years.

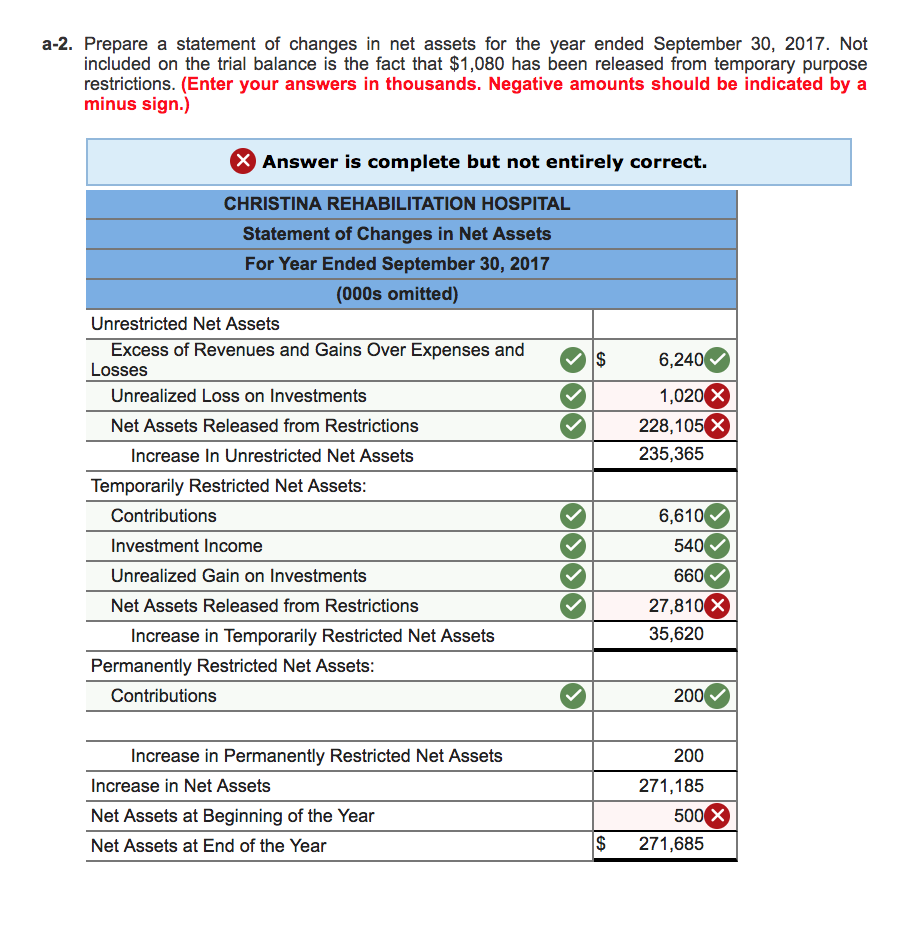

Clearly from your desk, its simpler to refinance just after a section thirteen case of bankruptcy than simply they is to refinance after a part 7 case of bankruptcy. A part 7 bankruptcy can be title your just like the a top-risk borrower so you can lenders because of your past problems paying bills.

If the unique mortgage is a government-supported FHA, Va or USDA mortgage, you’ll need to re-finance from the same department.