Very, you discovered a property you to checks away from every item toward your property wishlist – an open floor plan, the fresh hardwood floors, a patio for the dog, a college or university district – but it’s trying to find specific significant home improvements.

What is actually a renovation mortgage?

A restoration financing is home financing that also gives you while making status and you can repairs to your residence. There are some recovery loan choices for different kinds of consumers, for choosing a separate house and refinancing. An enthusiastic appraiser should determine just what home was worthy of immediately after all the home improvements is done, this is what a lender spends to choose your loan number. Instance, whenever you are to find a house that is $150,000, along with your home home improvements are needed to improve your property’s really worth by the $20,000, their recovery mortgage would be getting $170,000.

Recovery loan options

You will find several various other restoration loan choices: a conventional Repair financing, FHA 203(K) mortgage, otherwise Va Restoration loan. These options enable it to be borrowers who qualify so you’re able to rebuild their home otherwise buy a unique domestic when you are factoring in the costs from repairs and remodeling.

Old-fashioned recovery loan

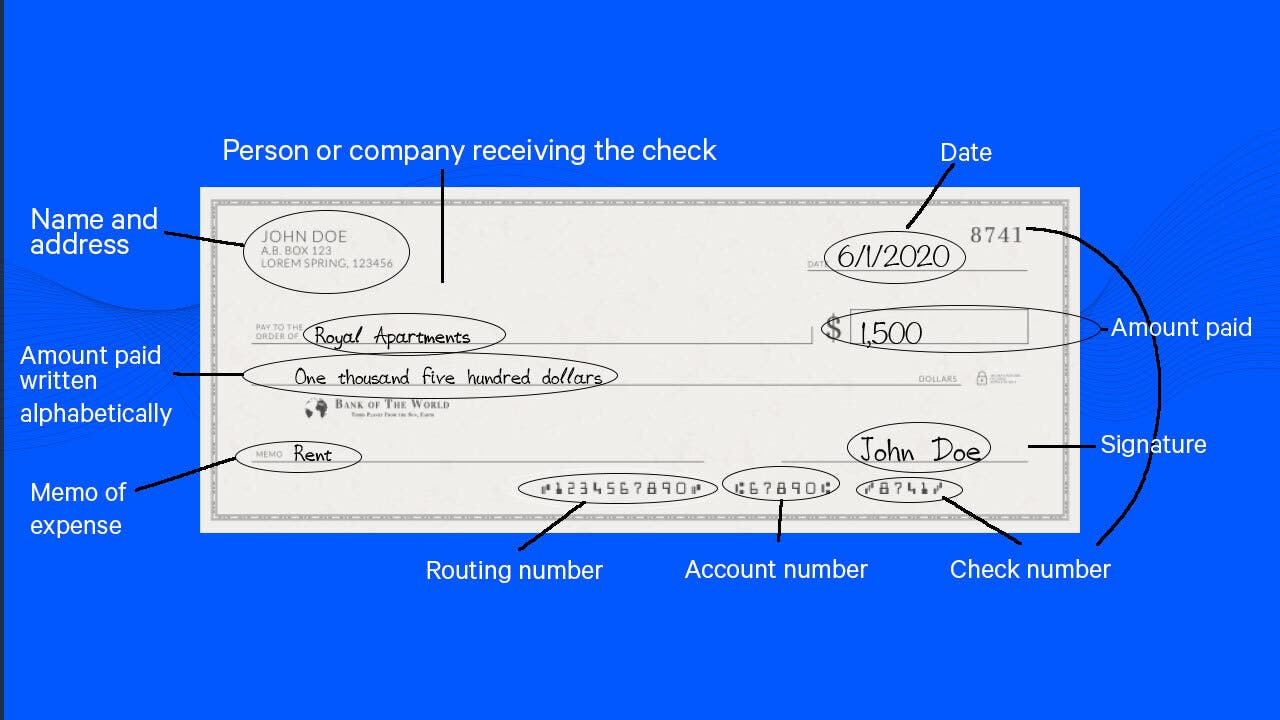

A traditional Repair loan allows you to purchase a property and you may grounds regarding the can cost you out-of repairs and renovations. It’s quite simple: one another your residence mortgage plus restoration costs are rolled to your you to definitely loan. This way, you just get one mortgage having one to month-to-month mortgage payment. The income that pay money for the latest renovations take place when you look at the an enthusiastic escrow membership unless you make use of them, that’s merely an alternative account that the lender sets up to invest specific expenditures (you additionally have escrow makes up your insurance and you will taxes). Choices for Traditional Recovery loans initiate in the $5,000 and you can extend to the restriction financing limitations near you. This 1 is a wonderful way for you to get into the new domestic and come up with status and you will repairs without the need to purchase several thousand dollars during the away-of-wallet recovery will set you back upfront.

FHA 203(K) Loan

An enthusiastic FHA Mortgage is financing backed by the fresh Federal Homes Administration. Which mortgage try a greatest alternative, specifically among earliest-time homebuyers, and features the lowest step 3.5% down payment. An FHA 203(K) financing provides you with the great benefits of an FHA financing, while also allowing you to funds family home improvements and you may repairs. Like the Traditional Restoration mortgage, an 203(K) mortgage goes their mortgage payment and you may recovery will set you back for the one to monthly mortgage payment. A restricted 203(K) loan covers repairs and you will home improvements one may include $5,000 to help you $35,000, while you are a standard 203(K) mortgage is actually for home improvements more $35,000.

Va repair loan

Good are secured of the Agency from Pros Items while offering favorable mortgage conditions so you can active obligations and you can retired service professionals. Just like the almost every other repair loan alternatives, a good Va Repair loan makes you plan repair can cost you on the your Va financial – that have that loan application, you to loan, and another monthly mortgage repayment. You continue to score every advantages of a traditional Virtual assistant mortgage, in addition to zero down payment choices, no loans in Jewett City private financial insurance rates, and you can less settlement costs, you end being required to score another financing to finance your renovations.

Refinancing which have a remodelling loan

Maybe you went into your house years back that have purposes regarding making change and you will standing, but never had to it. Refinancing that have a restoration financing may get you the family reputation you usually need. When you yourself have reached 20% collateral in your home, you’re entitled to refinance your house loan having a good restoration loan. This permits you to definitely tie the recovery will cost you towards the a new mortgage loan making change to your residence in place of paying thousand out-of bucks aside-of-wallet. A restoration loan could well be what need when you have found just the right fixer-higher, or if you need to make change toward latest household. Talk to your lending company on hence renovation financing choice is good for the money you owe and recovery need.